The key themes that have dominated markets since the financial crisis are broadly un-affected, and have been joined by a couple of their own by-products. The sequence of mini-selloffs since the crisis (the multiple EU periphery crises, the oil shock, etc.) have not only been overcome, but gradually lost the potential impact as each one has been followed by a stronger rebound. However, the outlook has a lower potential and some growing challenges.

Private sector balance sheets and profitability continue to drive markets higher and lead to economic growth, while the key risks remain on the public sector balance sheets and policies. Emerging economies continue to show higher growth rates than G7 economies, as well as the most promising investment opportunities. These have been secular themes since early 2009. The recovery in commodities, due to economic growth and global liquidity (courtesy of G7 central banks), has resuscitated inflationary pressures. Middle East political revolts propelled oil prices towards an oil-shock threat. Not to mention the potential for regime change in large and relevant countries (Syria, Iran, Saudi Arabia).

In sum, the driving phenomena since early 2009 have not changed dramatically, which is why the core elements of the structure of our portfolios have not changed significantly. Obviously, the upside potential is now more limited by a set of more normal value considerations. The key risks remain on the policy front in G7 (US fiscal deficit and debt, EU institutions and potential defaults), with the recent addition of geopolitics and its potential oil shock.

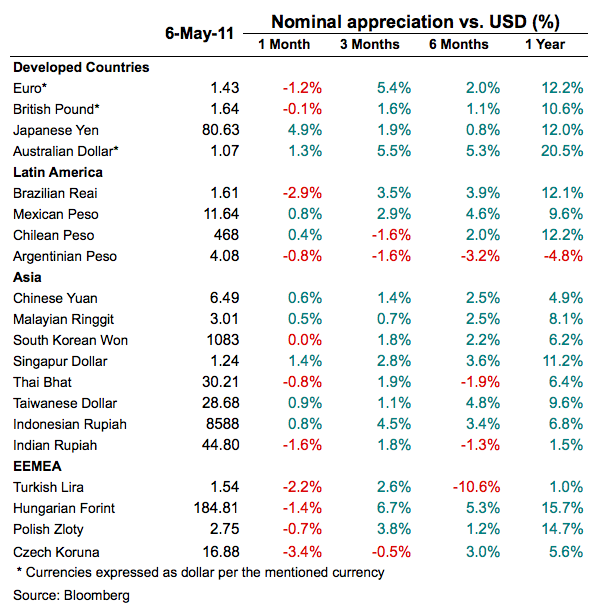

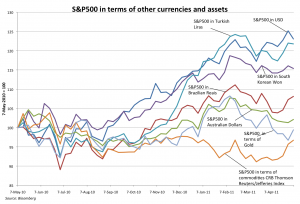

In this context, real assets (equities, commodities) and sound currencies would end up holding value better than the old reserve currencies. The table below shows how much have most currencies appreciated vis-à-vis the US dollar. The graph that follows shows that the impressive recovery of the S&P500 is not so impressive when denominated in other currencies or reserve assets (the S&P500 has basically doubled since its low in March 9 of 2009).

Among the driving forces mentioned above, global liquidity has been key. The US provision of liquidity has been broadly criticized. One of the key elements of that policy is expected to change in June, with the culmination of the so-called QE2 (the second quantitative easing program by the Fed). The Fed is not expected to sell the assets bought during these efforts, but it will no longer be the marginal buyer. Some fear this will mean the beginning of a sharp move higher in US rates. But markets have known about these events for months, and the fact that economic data during the last 2 quarters have shown a stronger and broader recovery means the probability of QE3 has been coming down steadily. If markets expected a severe rise in rates from a scenario without QE3, the slope of the yield curve should have increased as that probability of QE3 fell. The chart below shows the opposite.

To some extent, rates have actually come off recently as a result of incipient signs of another global growth deceleration, which is expected to be transitory. But economic data have become volatile recently, with some broad global indicators showing a slowdown is around the corner, but is the result of some temporary drags. But this is no longer a crisis scenario. We are now dealing with regular business cycle considerations, which are now global in nature. Profits from global companies are almost at the pre-crisis peaks, and there is no reason to dis-believe their growth forecasts.

However, the abnormal risks are those emanating from policy. If the US political system does not produce serious and credible signals towards a sharp change in its fiscal outlook, the dollar is bound to continue weak and weakening. If Europe does not address the deteriorating situation of its periphery, the euro is at risk.

We think the US political system is likely to address the short-term issues (extending the debt ceiling to avoid a technical default), but less likely to produce an agreement on the structural medium-term reforms needed for sustainability to produce a dollar comeback. On Europe we are a bit more skeptical about the timing and process. A three-way pre-emptive and coordinated restructuring (Greece, Ireland and Portugal) is nothing but an idealistic dream. While allowing or pushing one country to restructure is only prudent if the other 2 are clearly different and improving. For now, the most likely scenario is one where politicians continue to buy time. But the politics of buying time is deteriorating at the local level.

These are the reasons why our medium-term optimism about growth in Asia, Latin America, the US and northern Europe do not necessarily lead to portfolios ‘all in’ (highly exposed to risky assets), but still balancing value preservation (through equities, commodities, EM currencies, etc.) with caution. This approach has served us well on a risk-adjusted basis.

For more information view our contact info