April has so far been very volatile, as a result of the struggle between fundamentals showing incipient signs of a deceleration that brings fears of a now frequent seasonal pattern, and central bank liquidity on the other hand. Investors have grown fearful of every short-term correction, and the time of the year brings back memories of seasonal selloffs from the last 2-3 years. At the same time, Japan joined the aggressive monetary expansion crowd and the European Central Bank (ECB) is expected to cut rates next week.

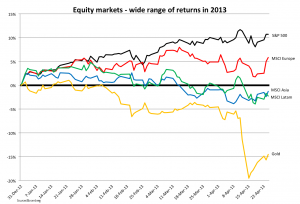

We maintained a high level of cash and still a conservative stance through these volatile weeks, though still showing a higher than average degree of regional diversification. The former helps minimize risk/volatility, the latter does not. US assets had outperformed until recently, and some reversion of that should be expected. Click on the charts below for illustration of the divergent performance of different regions or asset classes so far in 2013.

The current environment shows an uneven conflict between slow growth and fundamental risks on the one hand, and liquidity on the other. Here is a list of a few relevant phenomena:

Growth has moderated from a sharp acceleration through 4Q12 and part of 1Q13. That deceleration (especially in the US and China) provided the basis for fears of another April-May-June correction, similar to what had happened in previous years. Though there are no good reasons for a pattern to exist, investors are good Pavlovian responders. We do not see the growth moderation as a trend ending in no growth or a recession. We believe the key global macro risks have been postponed, and reforms and fundamentals now have time to work through those macro risks. Whether each is solved successfully or not it is yet too early to tell. We remain very skeptical about the Eurozone in the medium-term, but less so in the short-term.

The US economy, though at a more moderate pace, is bound to maintain growth. The fiscal deficit is now half what it was at the peak, and the trend is good despite the fact that a good tax reform has not been truly debated yet. We remain optimistic about efficiency gains from a gradual piecemeal tax reform process, on top of the benefits of a shrinking fiscal deficit. We have increased our exposure to some key sectors in the US, some close to real estate.

China converges to a more normal range. As we have said many times here and in client letters, China is converging to a more normal rate of growth and its economy is transitioning from an export and investment led economy to one where the consumer is more relevant (gradually converging to show more standard features). This process is not easy to predict and it has not been done before at such a large scale. As we had said, growing at 8-10% consistently is not normal, and a converging to show 5-6-7% in the upswing of a cycle should be expected. This is gradually becoming a consensus view (see The Economist last week). This process is bound to produce volatility in commodity prices, as well as other sectors and regions that have benefitted a lot from China’s emergence and growth. Other regions or countries might actually benefit from this convergence. Mexico is an example, as it now seems to be a better manufacturing location as Chinese competitiveness has deteriorated with growth (higher wages, stronger currency, etc.).

Earnings and valuations matter to a large extent, but global liquidity and the relative unattractiveness of most traditional fixed income segments seem to matter more. We see equities (including US indices) as still attractive from a fundamental stand-alone basis. Most metrics show them cheaper to fairly priced relative to historical norms, while earnings could have serious upside as economies recover. The earnings season so far has not been stellar, but is consistent with slow growth. But the dominating argument appears to be ‘relative value’ and the preference for real assets in the medium-term. Equities and other real assets (especially those with cash flows) are clearly more attractive than debt at the moment. And every marginal announcement on the monetary policy side is either of continuation or exacerbation. True that the US Fed has floated ideas on how and when it would retreat, but given the above, it is yet not likely to happen in the short-term, and when and if it happens it would be a very gradual process coinciding with better economic prospects. For now it pays to continue to think of the benevolent transition scenario as opposed to the catastrophic scenarios.

Reduce duration before killing debt. Despite the fashionable theme of a potential rotation from debt to equities, it continues to be possible to structure a low duration dollar debt portfolio that still outperforms some equity indices.

Europe is a medium-term concern. The ECB actions that helped to postpone the crisis and bring calm are also the reason why politicians feel no rush to produce and implement the necessary reforms. Cyprus was a relevant case in as much as it showed bailout fatigue in the rich countries, and started a debate on who should pay the costs of a bailout and how far to go on loss attribution. However, the critical medium-term issues are the institutional reforms that would bring more integration (banking union especially) and the local reforms that would minimize divergence among countries’ competitiveness.

Japan is a temporary distortion, and for now the question is how temporary. As we said many times, monetary policy alone cannot solve fundamental problems. But the new government seems determined enough that this effort is bound to last, and we should monitor other reforms and their effect in bringing real growth back. In the meantime, currency depreciation and real asset appreciation is bound to continue.

With these and other short and medium-term issues in mind, we continue to increase exposure to real assets, maintaining some regional diversification despite a preference/bias for US assets. The outlook is one of slow growth, with accidents here and there that is gradually less likely to become systemic.

For more information view our contact info