Market dynamics changed some time in October, as we switched from watching and fearing mostly external factors and risks, to now being mostly dependent on its own fundamentals and risks. The global business cycle is now the key market factor.

During the last 3-4 years the volatility in markets (therefore the downside risks) was mostly originated by idiosyncratic situations or policy risks that were mostly foreign to core markets and its valuation fundamentals. Those external factors had gradually been deactivated or resolved. Some of them were: Greece and the euro, then Spain and Italy, then Cyprus, then a sequence of self-imposed fiscal policy restrictions (debt ceiling, fiscal cliff, continuing resolutions, etc.), as well as the sequence of situations in Libya, Syria, Iran, etc. All those potential risks would have obviously had an indirect fundamental impact on markets if they had gone wrong, but not as much as the actual volatility they created throughout the last few years. As these risks were resolved, markets continued their upward trend. The main US equity indices crossed pre-crisis highs this year.

November was the first month in many with no such serious risk factors. Markets are now focused on the global business cycle, valuation, and monetary policy. The current valuation of US equity markets is at roughly historical average, which makes many people feel it is not overpriced, but not cheap either. This is a simplistic statement, and we look at many different metrics and their relative merits, but it is not the purpose of this article.

This is a particularly interesting but risky situation. There is no longer some focal point type of risk that everybody is looking at, and that everybody knows everybody else is looking at and waiting for resolution. Now, for the first time in many many months it is a matter of judgment, of valuation, of the forecast on the business cycle and how that economic outlook would impact companies’ earnings. With the market’s P/E ratio in the 16 area (other international markets are lower, but their historical metrics are also lower) it becomes more than ever a judgment on valuation, and whether low interest rates are enough to support higher rations. Whether interest rates going higher is good or bad for equity markets.

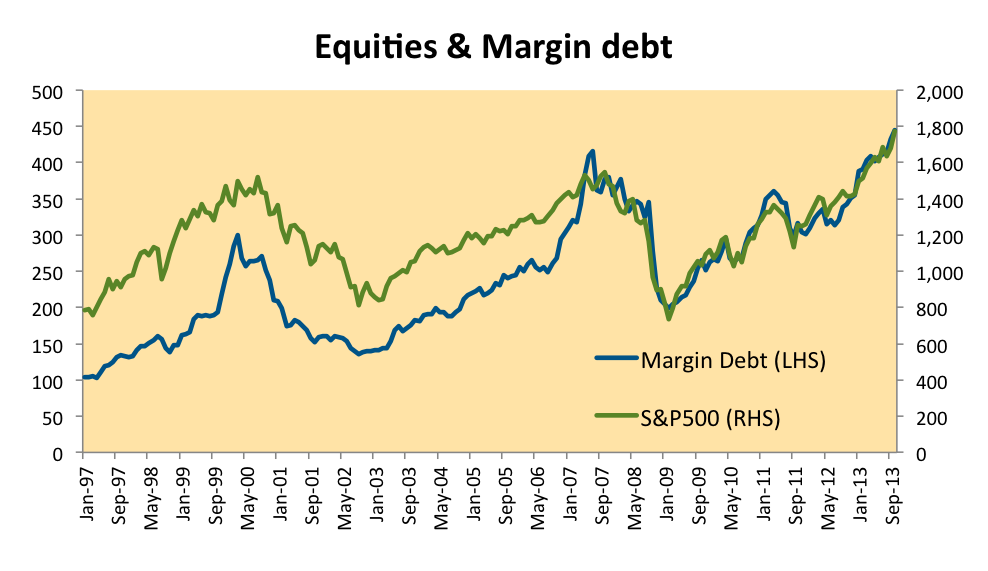

As this introspection and more traditional analysis is implemented in a world without the threat of a geopolitical conflict or the collapse of the euro, other internal factors become relevant and get looked under the historical prism. This has generated a laud debate on whether and when a market correction is due. One such area of focus, as an example, is the level of margin debt in the equity market (how much debt have equity investors taken to buy more equities). The chart below shows how correlated has margin debt been with the S&P500. Moreover, it shows how margin goes up, then goes up in parabolic fashion, which accelerates the rally in the S&P500, and then margin starts to fall, and a couple of months later equities fall, starting a vicious cycle of lower values leading to lower margin, which produces a further selloff. This happens in extreme cases, but it is precisely the idea here to be able to identify extremes.

This is one example of a phenomenon where observers focus to justify being cautious about the potential for a selloff. Our read is that a hesitant global economic cycle with equity markets at or above historical averages for the relevant valuation metrics provide for a fertile ground for risk aversion. It is still a bit early to justify a cautious approach and risk reduction. Economic data continue to point to an improving scenario. But earnings growth is needed for additional market gains, and that can only happen with higher economic growth. The longer it takes the more likely it is that markets produce a serious correction. Not because they are currently expensive, but because a low growth scenario allows for almost any apparently reasonable fear to cause a large group to sell, which then pushes or forces others to do the same for risk management reasons. In other words, with external risk factors deactivated, it is up to growth to take markets higher, and this is why today’s US labor market news provide a respite to markets.

For more information view our contact info