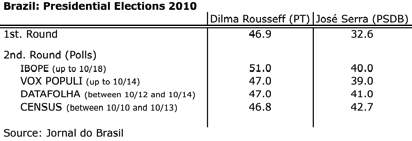

A boring second round electoral process -as the victory of the ruling party candidate Dilma Roussef (PT) seemed certain- gained momentum last week when results of some polls became public. Particularly, a poll by CENSUS showed an evident shrink of her advantage, with José Serra standing only 4 percentage points behind (see table).

But the emotion has soon vanished: new polls by the end of last week and the IBOPE one that appeared early this week, showed again a comfortable advantage of the PT candidate. The advantage is even larger than those of the polls that were published two weeks ago. Computing the results of the table in terms of valid votes, Dilma could be elected president of Brazil with 54/56% of the votes.

Runoffs are not rare in Brazil. Four out of the last six presidential elections were decided in a second round ballotage. In all six, current President Lula da Silva played an outstanding role: he lost three (1989, 1994 and 1998), he won two (2002, 2006), and he succeeded in promoting Dilma to next week’s runoff.

That’s why it seems difficult to imagine Brazil without Lula playing such a central role in Brazil’s politics. Moreover being Lula a synonym of Brazil’s destiny of developed country in a near future.

Brazil 2010 proves that the presidential figure is not so important (whether it is Fernando Henrique, Lula, Dilma or José), when there is an overall fundamental consensus (translated into Government policies) about key objectives such as macroeconomic stability, growth, property rights and a more fair distribution of wealth.

Thanks to the ongoing policies held by Lula’s government, following Cardoso’s legacy, Brazil has gradually opened his way to becoming one of the most outstanding emerging economies. Though there are still many challenges ahead, mainly cutting down poverty and inequality, and increasing investment in infrastructure, during the campaign, the main pillars that have been ruling the economy during the last two decades were not questioned by any candidate.

Brazil’s capital inflows are at its peak, no matter how tight the results of this presidential election are or could be. Such is the case that, on October 5th, economic authorities have decided to raise the tax over capital inflows from 2% to 4%, following concerns of a higher appreciation of the Real.

Since mid 2009, around 7.7 billion dollars have entered Brazil’s economy in a monthly average; part of these inflows has financed the current account deficit of 3.4 billion dollars, and the rest (around 4.3 billion) have been accumulated in the Central Bank of Brazil as reserves. This intervention has not been enough to avoid a 15% appreciation of the Real against the USD during this period.

It is likely that no additional increases in taxes on capital inflows or the threat of a stronger intervention in the exchange market will be enough to prevent further capital inflows from entering Brazil’s capital markets. The high interest rates offered by the local currency denominated bonds are very attractive even if there is a slowdown in the appreciation of the Real. On the other hand, the economy’s potential growth capacity remains strong, making local companies very attractive, for they have also started an internationalization process that allows them to make the most of economies of scale and improve their credit rating (thanks to the regional diversification of their markets and production structures).

Neither Dilma nor Serra is a threat for the continuity of this process. It is likely that Serra could make the markets become more bullish, even though it is not expected that he could have a very different monetary policy or exchange rate regime than Dilma (it is likely that she could keep Mantega and Meirelles as heads of Economy and the Central Bank, respectively).

Perhaps the only big difference, and the reason why Serra’s victory could generate more enthusiasm in the market, is that Serra is perceived as more capable of accomplishing Lula’s missing assignment: to get plenty enough investment in infrastructure (energy, transportation and logistics) so as to eradicate any doubt about Brazil’s ability to keep on growing at fast and sustainable rates.

The concerns stated above are for the medium term, and they require monitoring the real level of investment, the trade account balance, and other signs of economic convergence towards a developed economy. The idea behind this is being able to manage and analyze more efficiently Brazil’s intrinsic risks, as Brazil is seen today as a strong and growing country, which has several structural issues yet to be resolved.

For more information view our contact info