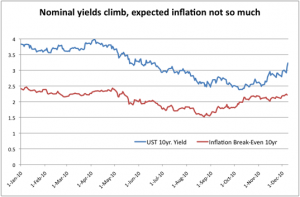

Many have already pointed out the irony of UST yields making a most drastic upward move while QE2 (the second round of Fed asset purchases) is being implemented. In other words, as the Fed is buying UST bonds, their prices are falling impressively. As can be seen in the chart, 10-year UST yields started a march higher at the beginning of October, and it looks that soon it will become a full 100 bps move (which has fallen in price about 6%). Three fairly obvious questions come to mind:

1- Is this the result of better economic fundamental data and its implied higher growth forecasts?

2- Is it because of higher inflation expectations?

3- Or, is it the result of bond vigilantes focusing on the US fiscal picture after Europe’s?

4- Is this the beginning of a massive fund reallocation from bonds back into equities, reversing more than two years of the opposite phenomenon?

It could very well be a combination of the four, or it could be just short-term volatility. There have been two central themes in our views and communications to clients (one older than the other one): higher G7 rates (and a steeper curves) as a result of massive fiscal deterioration together with monetary expansion; and, more recently but connected or a consequence of the first view, the long and drastic move out of equities into bonds has ended and will soon show the tide turning massively. This is why our fixed income portfolios have had very limited duration for a long time (trying to time this was deemed dangerous).

The announcement of QE2 was explicitly framed as an effort to bring inflation expectations higher, towards the target level of 2%. EM observers and policy makers are bound to interpret it as a bit more extreme (due to experience and mindset). Recall that EM policy makers are the ones that have and continue to accumulate reserves, thus the largest buyers of UST bonds. They could not help to see the combination of QE2 with a massive fiscal deficit and debt problem as a recipe for dollar weakness and eventual inflation. Thus, protecting the value of those reserves means diversifying away from the US dollar. The question is into what? The euro is not the best competitor at the moment, gold has had a tremendous run, and equities remain fairly volatile. It is not an easy task, but it is a necessary task, similar to our asset allocation efforts.

Fundamental data from the US economy, as well as northern Europe has been improving lately. If this was the key motivation, we should also see higher commodity prices and higher real rates at the same time. Real rates have come up a bit, as shown by the fact that the inflation break-even has not accompanied the run up in nominal yields of the last 2 months. Commodity prices in general have not necessarily moved as much, when judged relative to the previous 2 month move (the general CRB index rose a bit more than 5% since early October, gold about 3%, relative to 8-10% the August-September period). At the same time the dollar index (an average of its bilateral FX rates with other 6 major currencies) has not done nothing drastic. We rarely would see perfect correlations in market moves. What matters is that we are seeing higher real interest rates, higher commodities prices while economic fundamentals are slowly improving in G7. True that the developing world continues to grow faster than G7, and already amounts to a similarly large share of world GDP.

Clearly, the fact that November saw the return of the euro crisis pollutes any read of other market signals. Moreover, the fact that during this last euro crisis episode the “risk less” UST curve has steepened significantly is very telling. Moreover, German Bunds 10-year yields have gone through the same type and magnitude of a move in the same time period (from 2.25% in early October to 3.01% this Wednesday). The German economy was following the US recovery patter with a lag of about 6-8 months, though very recently there have been signs of reacceleration. The global business cycle appears to maintain a high level of synchronicity.

Though we are concerned about the US fiscal situation and its debt dynamics, we have seen marginally positive news over the last two months (better fundamentals, the congressional elections, the fiscal commission, etc.). With the exception of this weeks tax deal between President Obama and the Republicans, the fiscal debate had improved over the last 2 months, which does not totally preclude bond vigilantes from starting their work on the bond market. But we believe the US has more time, leeway, and credibility on the fiscal front than small European countries. This view on the US and the dollar has been a central theme throughout the last 18 months in our portfolio allocation decisions.

In sum, we see these curve moves (G7 long-end selloffs) as the beginning of a reallocation away from bonds into equities and other real assets, as well as a move away from potentially weaker currencies where the temptation of inflation as a fiscal adjustment tool is too much to bear. Whether this move will accelerate or take a breather is hard to know, and will depend on data and other events. But we have been gradually moving away from our cautious stance of equities plus commodities below 40%. Our currency diversification stance, together with our reliance on emerging markets have served us well.

For more information view our contact info